Key Findings

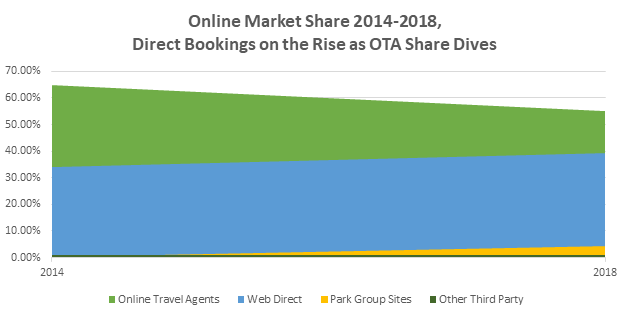

- OTAs losing market share but still leading online holiday park bookings at 55% share.

- Direct bookings to overtake OTA bookings by 2024 if present trajectory continues.

- Online, including direct/OTA, is the fastest-growing sales channel for holiday parks.

- Flat rates/revenue mean direct bookings best way to increase revenue and cut costs.

- Direct strategy allows operators to ‘own’ customers and save on OTA commission.

- OTA sector a straight duopoly – there’s no competition for Booking.com or Expedia.

- Booking.com clear #1, outselling Expedia 3:1 in holiday park market and pulling away.

- Holiday park stays getting shorter while booking lead times have increased.

- Online holiday park bookings through RMS grew 25% a year between 2014 and 2018.

“The landscape has shifted, and the data shows that for the first time ever the Online Travel Agents are losing market share to holiday park operators,” says Buttigieg.

“Previously it’s all been one-way traffic in the other direction, but now smart operators have lifted their online game and are fighting back, often with great success, demonstrating that given the choice and a great deal many consumers prefer to book directly with suppliers.”

Holiday Park Operators Boost Direct Bookings

Meanwhile consumer direct bookings on independent holiday park websites rose by 15%, climbing from 34% in 2014 to an all-time high of 39% in 2018.

But it hasn’t all been plain sailing. These booking increases have been hard won with ebbs and flows in market share along the way.

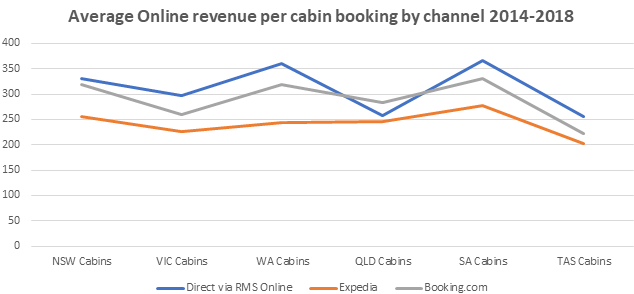

Direct Bookings Much More Profitable for Operators

Direct cabin bookings generate an average of 21% more revenue per booking than Expedia and are 10% more lucrative than Booking.com, the analysis of 2 million online bookings shows.

When the 15% average commission charged by OTAs is factored in, the income differential between direct and OTA bookings can exceed 30%*.

*It must be noted direct bookings often comes at a cost such as marketing, website development or price incentives.

Flat Rates Big Driver of Online Booking Push

Holiday park rates peaked in 2015 and it’s been mostly downhill ever since. The reality is operators have no pricing power outside peak holiday periods and, even then, some are reluctant to challenge the status quo. As a result, profits in the industry are under pressure and it’s easy to see why operators are putting a greater emphasis on direct bookings.

And Then There Were Two…

Despite the progress Australian holiday parks have made over the past 18 months in reclaiming online share, the OTA duopoly of Booking.com and Expedia still have 55% of web bookings. These two companies are famously competitive but in the Australian holiday park market, Booking.com is the clear OTA leader and pulling away.

More Planning But Fewer Nights

Holiday park stays are getting shorter while average booking lead times have increased. The average booking in 2018 was made 39 days out, up from 30 days in 2014. There’s no obvious reason for this trend, which runs counter to the ‘just in time’ world we live in.

Meanwhile, average nights per stay has fallen 10%, from 2.09 nights to 1.88 nights. While it doesn’t sound like much, when combined with flat or declining rates, this fall has significantly impacted the average revenue per booking.

Conclusion

After many years of allowing the foreign-owned OTAs Booking.com and Expedia dominate online holiday park bookings, Australian holiday park operators are fighting back. They are investing in their websites and online presence while pushing book direct offers to consumers, cutting out the middlemen and saving on hefty commission rates.

In an era of stagnant rates, it’s their best option to maintain or increase profit, and for that reason alone it is fair to assume 2018 marks the leading edge of a longer-term trend, one that over time may eventually see direct bookings exceed those coming through the OTAs.