In an era where digital footprints are scrutinized more than ever, a groundbreaking study by Surfshark’s Research Hub has unveiled startling data privacy trends, spotlighting popular finance apps. This extensive research, analyzing 100 top apps from the App Store, including giants like PayPal and Robinhood, brings to light the substantial amounts of user data these applications collect and share.

In an era where digital footprints are scrutinized more than ever, a groundbreaking study by Surfshark’s Research Hub has unveiled startling data privacy trends, spotlighting popular finance apps. This extensive research, analyzing 100 top apps from the App Store, including giants like PayPal and Robinhood, brings to light the substantial amounts of user data these applications collect and share.

A Deep Dive into Data Collection

The Surfshark study, an eye-opener in the digital finance domain, reveals that, on average, finance apps gather information across 16 out of 32 possible data points defined by Apple. This figure surpasses the average data collection across all apps and indicates a significant privacy concern for users. Remarkably, these apps link a staggering 93% of the collected data to the user’s identity, painting a concerning picture of personal privacy in the digital age.

The research spotlights PayPal and Robinhood as the most data-hungry apps in the finance sector, collecting 26 and 25 data points, respectively. Contrary to common assumptions, these apps do not use the data to track users, but their extensive data collection practices raise essential questions about user privacy.

App Privacy Checker is a free tool Surfshark’s Research Hub developed to aid this research. Users can select which apps they use and get to know exactly how much data they are giving away, which can be found here.

Mint: A Concerning Case of Data Sharing

Among the findings, one of the most alarming is the behaviour of the app Mint. Approximately 70% of the data points collected by Mint are used for user tracking, encompassing sensitive information like email addresses, precise locations, credit information, and purchase history. This extensive data sharing with third parties is a clarion call for users to be more vigilant about their digital privacy.

The Landscape of App Privacy

The study, which spanned ten different finance apps, found that only half refrained from using data to track users. This revelation is critical in an age where digital autonomy is fiercely debated. Surfshark’s Lead Researcher, Agneska Sablovskaja, emphasizes the importance of understanding an app’s privacy policy for safeguarding one’s digital autonomy.

Beyond Finance: A Broader Perspective

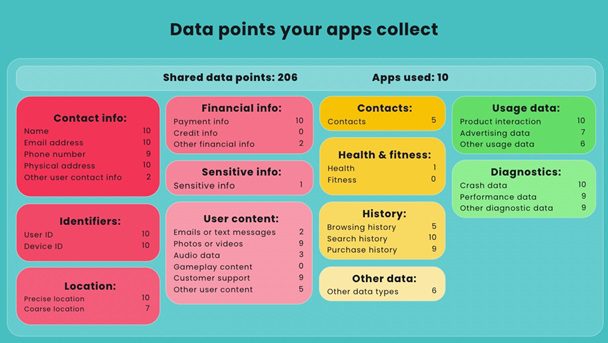

The scope of the study extends beyond finance apps. It encompasses 100 popular apps, uncovering that they collectively gather 1523 unique data points. This translates to an average of 15 unique data points per app, with around 90% of them collecting essential usage, diagnostic, and identifier data for app functionality.

A startling finding is that nearly half of these apps collect users’ precise locations, while a third access contacts, and a fifth delve into emails, text messages, and browsing history. This pervasive data collection highlights the ubiquitous nature of digital tracking in today’s app ecosystem.

The Extremes: Facebook, Instagram, and Signal

At one end of the spectrum lie Facebook and Instagram, identified as the most privacy-invasive apps. They are the only two apps in the study that collect all 32 data points defined by Apple. On the other end, Signal stands out as the second least data-hungry app in the social media and messaging category, collecting only one data point that is neither linked to the user nor used for tracking.

Recommendations for Digital Safety

In light of these findings, users should scrutinize the developer’s reputation and data retention policies before downloading apps. Paying attention to constant permission requests and limiting app access to personal information can significantly enhance digital safety.

Methodological Rigour

The methodological rigour of Surfshark’s study is noteworthy. The research analyzed apps across ten categories, selecting them based on their popularity in search engine results. The evaluation was based on three layers of data points: collected, linked to the user, and used for tracking. This comprehensive approach underscores the study’s credibility and relevance in today’s data-driven world.

A Call for Digital Autonomy

This study serves as a crucial reminder of the importance of digital autonomy. With finance apps collecting more data than ever, the onus is on users to remain informed and vigilant. Understanding the nuances of app privacy policies is no longer optional but necessary to safeguard personal information in the digital age.

In conclusion, Surfshark’s study is a wake-up call for users and app developers, spotlighting the urgent need for more transparent and responsible data handling practices in the digital finance sector. As technology continues to evolve, so must our understanding and approach to digital privacy.

Additional Information:

For the complete research material behind this study and to understand more about app privacy practices, visit Surfshark’s official website.

Written by: Soo James