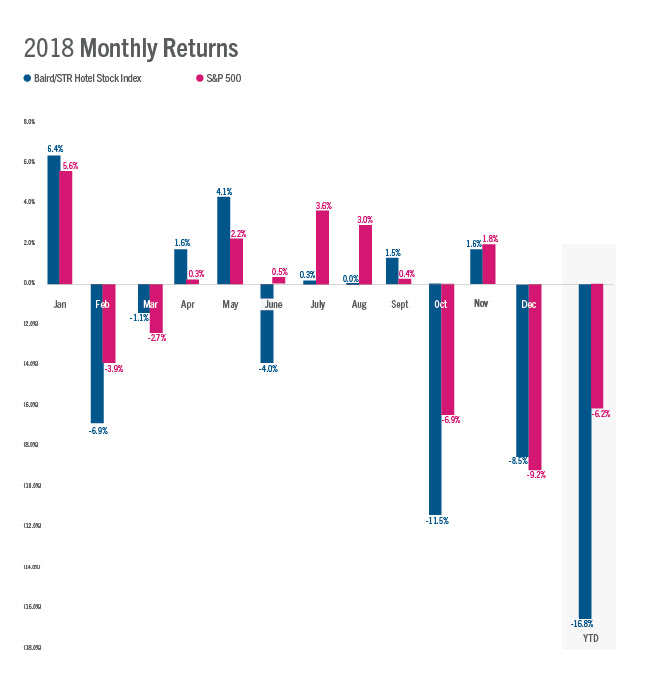

The Baird/STR Hotel Stock Index was down 8.5% in December to 4,069. For total-year 2018, the stock index fell 16.8%.

“Hotel stocks declined meaningfully in December and capped off a year of underperformance as investor sentiment broadly continued to deteriorate,” said Michael Bellisario, senior hotel research analyst and VP at Baird. “The hotel REITs and the hotel brands fell 13.9% and 5.5%, respectively, in December, and the sub-indices declined 17.5% and 16.3%, respectively, in 2018. The year was marked by significant volatility, and initial optimism around tax reform for the brands and M&A upside for the REITs quickly faded. However, given that we do not expect fundamentals to meaningfully decelerate in the near term, we view valuations as more attractive at current levels even in the face of heightened macroeconomic uncertainties.”

“Uncertainty from a policy and global markets perspective continues to create stock volatility and widen the disconnect between industry fundamentals and investor sentiment,” said Amanda Hite, STR’s president and CEO. “This stands in sharp contrast to the connection between hotel industry performance and the overall macroeconomic outlook in the U.S., which is actually—even though tempered—still quite positive. Hotel performance results for Q4 look to be lower than expected, and muted RevPAR growth is probably a sign of things to come. But the continued GDP growth outlook coupled with a very low unemployment rate and a growing labor participation rate gives us conviction that demand and ADR will continue to grow in 2019.”

The Baird/STR Hotel Stock Index’s performance was ahead of both the S&P 500 (-9.2%) and the MSCI US REIT Index (-8.8%).

The Hotel Brand sub-index decreased 5.5% from November to 6,160, while the Hotel REIT sub-index dropped 13.9% to 1,389. For the year, the brand sub-index fell 16.3%, while the REIT sub-index was down 17.5%.