How much do you love travelling? GoBear, the financial products comparing platform, has sorted some popular trips for you to tick off the travel bucket list. Check out these locations to get some inspiration when planning your upcoming winter trips. To best enjoy your journey and avoid any accidents ruining your holiday, it’s a good idea to get familiar with different travel insurance policies, so GoBear has some tips and promotions to help you find the best protection and best deals for your next vacation.

Family Road Trip – Share Stunning Moments in Iceland and Seek the Best Protection for Your Loved Ones

Do you want to fulfil two wishes in one trip? Plan a self-driving trip with family, have a quality time with your parents, siblings and kids during the trip while you can also take pleasure in having greater flexibility with your trip schedule. While countries in Asia Pacific, such as Japan, are popular destinations for HongKongers, Iceland is also a perfect destination for self-driving, where you will be able to take in the magnificent scenery of popular spots like Thingvellir National Park and Strokkur. Drive down the famous road of Skagafjordur and experience one of the best places in the world to witness the splendour of the Northern lights with your loved ones. Download the self-drive guide book from GoBear to get more self-driving tips and destination recommendations!

While it’s easy to get carried away with your exciting plans, be mindful to also organise a travel insurance plan that covers all your needs during your trip. Don’t forget to look into the policy exclusion on the personal accident and medical expenses, as well as minimum and maximum insured age, especially when you travel with elderly holiday-seekers.

3 tips for choosing a travel insurance plan:

• Before you rent a car and go on a road trip, note that the loss of property or third-party casualties are not covered in general travel or car insurance. Even when the policy includes “Car Rental Additional Protection”, it may only cover the deductible, so choose plans that cover third party liability and Rental Vehicle Excess Coverage to lower the risk.

• If you are planning to do paragliding to enjoy the picturesque views of Iceland with your family, note that some insurers do not cover those aged 70 or above for extreme sports. Make sure to look into the terms and conditions if you are planning to do so with your parents and grandparents.

• If you are traveling with family, you may want to consider getting a bundle or package deal to save on costs. However, be mindful that not all travel insurance plans cover people aged 70 or above. Have a look on the specific terms if you are choosing one for your parents or grandparents. Find the travel insurance plan that best fits your needs on GoBear.

A Spontaneous Backpacker Journey – Insurance Has Your Back!

Spontaneous backpackers tend not to plan the itinerary in advance and love exploring places that they’ve never been before to maximise the sense of adventure. If Europe is on your wish-list, why not grab a Eurail Global Pass and travel around France, Italy, Germany and Switzerland, embarking on an eye-opening journey that will leave you lots of precious memories. Just remember that, while backpacking may be incredibly fun, it may also expose you to greater risks, such as theft when sharing accommodation or loss when moving from one destination to another, so never skip insuring your trip.

While looking at the terms and conditions, check the different types of incidents that you’ll be covered for. Insurers may only accept claims that cover specific conditions, and these can vary greatly from provider to provider.

• For example, flight delay or cancellation caused by extreme weather, natural disaster, strike, airport closure and riot are covered under travel insurance. However, the terms for incidents are different for each policy, which may not be covered by the insurance plan. Flight delay or cancellation caused by rearrangement of flight crew or public meeting at airport may not be covered by the policy since they could be regarded as ‘man-made’ factors.

• You can also make a claim during your long backpacking trip if all the documents required are ready and if your insurer accepts online applications. To facilitate the process of making a claim, it’s important to provide all necessary documents requested by your insurers. For example, if you encounter a theft, you need to report it within 24 hours and get an official document that shows you have made that report. Just note that pre-existing incidents are not covered, so purchase your insurance early. Get a list from GoBear on required proof for commonly applied claims on luggage damage or loss.

A Solo Adventure – Include Extreme Sports in Your Plan and Dive into the Adventurous ‘Me-Zone’ Abroad

Are you longing for an adventure just for you? A solo trip is absolutely the ideal option to jump out of your comfort zone with a series of daring challenges and experience a quality “me-time”. Costa Rica may be perfect for those who like to explore a new land on their own. If you want an unforgettable experience, bungee jumping, paragliding or even joining a marathon to enjoy unforgettable street views may be your cup of tea! Be ready for the adventure and get the right travel insurance plan to cover everything from extreme sports, to fun-runs!

Travelling alone carries its own unique risks, so remember the following tips:

• Beware that competitions including marathons are usually not covered under general travel insurance. You may need to consider an additional runner plan which covers running injuries and associated medical expenses.

• Extreme sports, such as skydiving, skiing, and scuba-diving are not usually covered by general travel plans, while the definition of extreme sports also varies among plans, so make sure you find a policy that covers the more thrilling activities you are planning. Compare different travel plans on GoBear to make a wise choice.

• Incidents that happen when you are alone can mean that your options for getting yourself out of trouble can be limited. Jot down the 24/7 service hotline (Emergency Travel Assistance) of your insurer to seek advice when necessary.

Travel with Good Deeds – Get the Right Insurance Plans for Volunteerism

Travelling can be both exciting and immensely rewarding. Volunteer travel (Volunteerism) has become more popular in recent years, giving travellers a one-of-a-kind experience that they can never have when exploring a city as a tourist. Peru, having recently suffered in the aftermath of a major flood in 2017, may be a destination to consider spending time to help those who need it most. South Africa also offers spaces for travellers to give their time assisting with wildlife conservation projects.

Make sure to remember the following while planning your volunteering trip:

• Volunteerism involves visiting locations and taking part in activities unlike a normal holiday, so ‘general’ travel insurance may not provide enough coverage or even violate the terms and conditions set out by the insurance company. So, remember to seek advice from your volunteering trip organization on insurance plans which cover volunteering activities and associated risks.

• Similar to a working holiday, travellers can also select plans to cover more than just tourist activities, with the ability to purchase more than one insurance plan to cover events in all necessary natures. Always check and compare the policy details on GoBear before you commit!

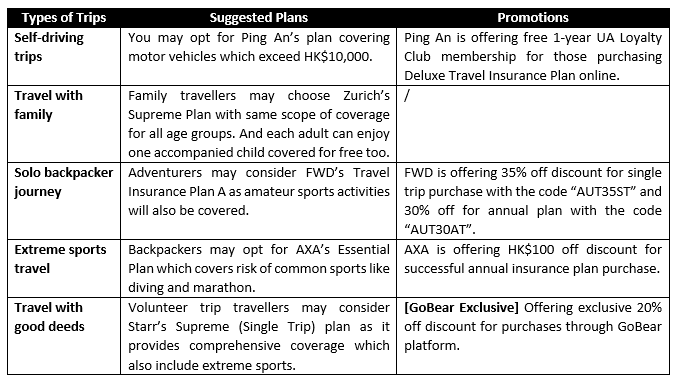

Don’t miss out on our promotions! Here are some plans that may fit many of the above featured trips.

Types

For more details on the limited-time promotions and available products, visit GoBear, the financial products comparing platform. You can also compare different insurance plans on GoBear to find the best fit for your upcoming journey.