The global aviation industry saw a massive decline in the number of passengers owing to international border closures. Sydney Airport recently highlighted that people’s keenness to travel would back the recovery process, anticipated to be non-linear. Besides, Qantas expects that international travel could resume from October-end this year.

The pandemic juggernaut weighed heavy on the business community, with results from the recent reporting season of ASX-listed companies narrating the adversities befallen on the air travel industry. Pretty impressively, investor sentiments remained buoyant, sitting in juxtaposition with the grim results.

Several businesses, through their cost-cutting initiatives and Government supports, are in a leveraged position for jumping back when travel markets reopen. Meanwhile, the vaccine rollouts and globally improving scenario continue to instill optimism in the travel recovery.

After Webjet Limited (ASX:WEB) in mid-Feb posted a massive drop in revenue for the first half of FY21, many other ASX-listed travel companies noticeably followed suit. Albeit the stock market continues to reverberate positive trends.

Sydney Airport (ASX:SYD) ended the day’s trade at $5.84, down 0.5% on 4 March 2021. Meanwhile, Webjet Limited (ASX:WEB) witnessed an uptick of over 0.5%, closing at $5.61. Qantas Airways Limited (ASX:QAN) quoted $ 5.08 a share and traded up by 0.9%.

In this backdrop, let us look at the latest results from two key ASX listed aviation industry players, highlighting the recovery potential.

Sydney Airport (ASX:SYD)

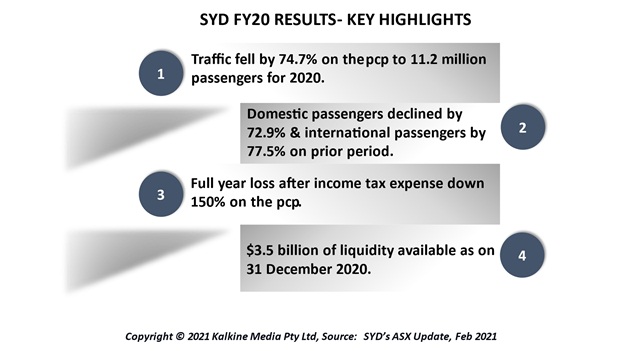

In the wake of the COVID-19 crisis, Sydney Airport responded through several operational changes allowing to keep the airport open to facilitate essential travel, medical supplies, exports, and repatriated Australians. Sydney Airport released its full-year results on 24 February 2021.

Sydney Airport decided to not pay any dividend for 2020, given the pandemic impact on passenger numbers and revenue. While the Airport reached many expiring or expired aeronautical agreements, it indicated possibilities for further extensions to the agreement in 2021 when greater clarity about the situation is gained.

CEO Geoff Culbert indicated that while recovery is not expected to be linear, there is optimism that the travel industry will be back in the saddle, owing to people’s keenness to travel and rampant vaccine rollouts.

Notably, Sydney Airport’s financial and operational response to COVID-19 has put it in a strong position to make the most of the recovery process.

Qantas Airways Limited (ASX:QAN)

Qantas has announced results for the first half of FY21. During the period, Qantas remained severely affected by the border closures.

While international travel remained off-limits during the pandemic, Qantas Airways saw significant domestic travel demand when restrictions for domestic travel remained relaxed.

During the period of eased relaxations, both Qantas and Jetstar witnessed exceptionally robust leisure travel demand, with over 0.25 million Jetstar bookings made during the sale activity in November 2020. At the same time, the Group’s cash flow remained bolstered from the resources sector demand.

Qantas’ cost-cutting and capital raising from debt and equity have ensured a high level of liquidity. Furthermore, it is undertaking a three-year major restructuring program to deliver permanent annual savings of at least $1 billion from FY23 onwards. Qantas indicated that the Group is on track to achieve its interim target of $600 million in permanent savings for FY21.

Based on several factors, Qantas anticipates that international travel could restart from October-end this year. However, trans-Tasman flying scheduled to commence in July 2021 could provide early relief to the ailing industry.

All in all, the priorities of travel companies are the safety of everyone who travels with them, getting as many people as possible back to work and generate positive cash flow to repair the balance sheets. The COVID vaccine rollout in Australia may take time, but the fact that it is underway gives companies more certainty.