According to an amazing report by Nica San Juan and research data analysed and published by ComprarAcciones.com, while the world’s top three cruise companies have survived 2020, the cash burn and debt burden they have accumulated is massive and staggering.

According to an amazing report by Nica San Juan and research data analysed and published by ComprarAcciones.com, while the world’s top three cruise companies have survived 2020, the cash burn and debt burden they have accumulated is massive and staggering.

The report says that Norwegian Cruise Lines had accrued a total debt burden of $USD12.15 billion at the end of 2020, with the company having reported $USD11.3 billion in debt at the end of Q3 2020 and it went on to issue senior notes worth $850 million in December 2020.

For the third quarter of 2020, the company had announced a monthly cash burn rate of $USD150 million and that would imply an annual cash burn of $USD1.8 billion, with on the bright side though, it has $USD2.7 billion in debt refinancing over the coming three years.

On the other hand, Carnival Corporation announced total debt amounting to $USD24.9 billion as of August 2020, with it having raised close to $USD20 billion via share and debt offerings by the end of the year and at the end of November liquidity stood at $USD9.5 billion.

As of February 2021, the total debt figure had risen to $USD30 billion, with in that one month, it raised $USD3.5 billion in a debt offering, announcing plans to raise a further $USD1 billion.

Additionally, the company has $USD4.2 billion in debt refinancing that is due within 24 months and during Q4 2020, it had estimated a monthly cash burn rate of $USD530 million.

As of September 2020, Royal Caribbean had a debt burden of $USD18.95 billion, with its interest expense for the first nine months of the year totalling $USD258 million, with on an annualized basis, that would translate to around $USD344 million.

In 2020, it raised $USD9.3 billion in new capital, with this coming from debt offerings as well as a stock sale of $USD1 billion in December 2020.

In total, the three cruise giants have accumulated an absolutely staggering more than $USD60 billion in debt so far over the pandemic period, with this figure is expected to increase further as they prepare to retake the seas.

On the bright side though, analysts and stakeholders expect 2021 to be the year of recovery for the battered industry, with according to Royal Caribbean Group executives, future bookings are up 30% since the start of the year, compared to November and December 2020.

In response to the bullish report, analysts raised their price targets on the stock sending it on an upward trajectory, with Deutsche Bank raising its target from $USD62 to $USD79, while JP Morgan went from $USD91 to $USD100.

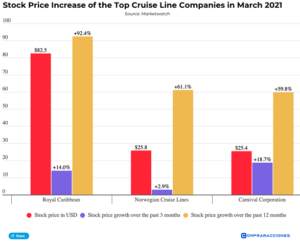

at of other cruise stocks surged upward, with according to data from Marketwatch, Royal Caribbean shares are trading at $82.45 as of March 24, 2021, with over the previous three months, its stock price has increased by over 14% and is also up by 92.36% over the one-year period, a remarkable feat considering it sank by 44% in 2020.

Similarly, Carnival Corporation and Norwegian Cruise Lines have been on an upward trajectory since the start of 2021, with Carnival stock trading at $USD25.40 at the time, up by 18.67% over the previous three months and by 59.81% over the one-year period.

Norwegian Cruise Lines is trading at $USD25.79, up by 2.97% over the previous three-month period and 61.11% over the one-year period.

While the uptrends have a correlation to the positive commentary from Wall Street, they are also a signal of good news to come.

Carnival Corporation revenue is expected to shoot Up by 13.6% in FY21 and 227.4% in FY22, with for the fourth quarter of 2020, Royal Caribbean had a net loss of $1.37 billion, the figure sending its annual loss to $USD5.8 billion against $USD2.2 billion in revenue.

The company’s Q4 2020 revenue underperformed analyst expectations, at $USD34.1 million against the expected $USD35.6 million, a far cry from its Q4 2019 figure of $USD2.52 billion, with a loss per share of $USD5.02, versus the anticipated $USD5.20.

Meanwhile, Carnival Corporation posted a net loss of $USD2.2 billion during its fiscal Q4 2020, which ended in November 2020, with Norwegian Cruise Lines yet to report earnings but the company lamented that 2020 was the most difficult year in its five decades of operation.

According to analyst projections, Carnival, the largest of the three cruise lines, will see revenue rise by 13.6% in fiscal 2021 and in 2022, the increase will be a remarkable 227.4%.

For the world’s second largest cruise company, Royal Caribbean, analysts project an upside of over 80% for stocks post-COVID, however, the outlook is pessimistic for Norwegian Cruise Lines, with revenue expected to fall by 67.8% in 2021.

An edited report from ComprarAcciones.com by John Alwyn-Jones